Delving into the realm of Term Life Insurance Quotes for High Income Earners, this introductory passage sets the stage for a comprehensive exploration of the topic. It aims to captivate readers with insights and knowledge, promising an enriching reading experience ahead.

The following paragraphs will shed light on the intricacies of term life insurance, particularly tailored for individuals with high income levels.

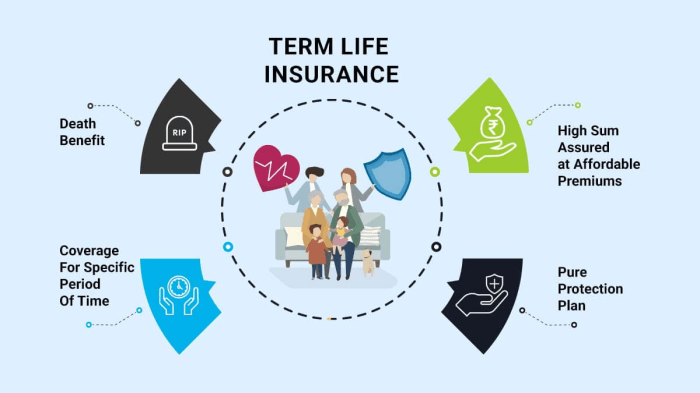

Introduction to Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It differs from other types of life insurance, such as whole life or universal life insurance, in that it does not build cash value over time.

Instead, term life insurance is designed to provide a death benefit to your beneficiaries if you pass away during the term of the policy.

Key Features of Term Life Insurance

- Term length: Term life insurance policies are typically available for terms ranging from 10 to 30 years, providing coverage for a specific period.

- Death benefit: Term life insurance policies pay out a death benefit to your beneficiaries if you pass away during the term of the policy.

- Affordability: Term life insurance is generally more affordable than other types of life insurance, making it an attractive option for high-income earners looking for cost-effective coverage.

- Renewability: Some term life insurance policies offer the option to renew or convert to a permanent policy at the end of the term.

Importance of Term Life Insurance for High-Income Earners

For high-income earners, term life insurance can provide financial protection for their loved ones in the event of their untimely death. It offers a cost-effective way to ensure that their beneficiaries are taken care of and can maintain their current lifestyle.

Additionally, term life insurance can help high-income earners cover large debts, such as mortgages or business loans, and estate taxes, providing peace of mind knowing their financial obligations are covered.

Factors to Consider for High-Income Earners

When it comes to high-income earners looking for term life insurance, there are specific factors to keep in mind to ensure adequate coverage and financial protection for their loved ones. Income level plays a crucial role in determining the coverage amount and policy duration that best suit their needs.

Coverage Amount and Policy Duration

High-income earners often have greater financial responsibilities, such as mortgages, children's education, or other significant expenses. As a result, they may need a higher coverage amount to ensure their family's financial stability in case of an unforeseen event. It is essential to assess the current lifestyle and future financial needs to determine the appropriate coverage level.For policy duration, high-income earners may opt for longer terms to cover extended financial obligations, such as paying off a mortgage or funding their children's education.

Choosing a policy duration that aligns with these financial milestones is crucial to ensure adequate protection throughout these periods.

Scenarios for Term Life Insurance Benefits

One scenario where term life insurance is beneficial for high-income individuals is providing income replacement in the event of premature death. This ensures that their family can maintain their standard of living and financial security despite the loss of income.Another scenario is estate planning, where high-income earners can use term life insurance to cover potential estate taxes or provide a financial legacy for their heirs.

By incorporating life insurance into their estate plan, they can protect their assets and provide for their loved ones without compromising their financial goals.Overall, high-income earners should carefully consider their financial obligations, future needs, and long-term goals when choosing term life insurance to ensure comprehensive coverage and peace of mind for their loved ones.

Comparison of Quotes

When it comes to obtaining term life insurance quotes for high-income earners, the process is quite similar to that of individuals with lower incomes. However, there are certain factors that may influence the cost of premiums for this demographic.Factors that influence the cost of term life insurance premiums for high-income earners include their age, health status, occupation, lifestyle choices, coverage amount, and the term length of the policy.

High-income earners may be required to undergo more extensive medical underwriting due to the larger coverage amounts they typically seek.

Differences in Coverage and Pricing

- Insurance Providers: Different insurance companies may offer varying coverage options and pricing for term life insurance policies. It is essential to compare quotes from multiple providers to ensure you are getting the best coverage at a competitive price.

- Medical Underwriting: High-income earners may have access to accelerated underwriting processes, which can expedite the approval process but may also result in higher premiums based on the individual's health and lifestyle factors.

- Policy Riders: Some insurance providers offer additional policy riders that can enhance coverage options, such as accelerated death benefits, disability income riders, or long-term care riders. These riders may come at an additional cost but can provide valuable protection.

- Term Length: The length of the term chosen for the policy can impact the pricing of premiums. High-income earners may opt for longer terms to ensure coverage throughout their peak earning years, which can affect the overall cost of the policy.

- Additional Benefits: Some insurance providers offer unique benefits or perks for high-income earners, such as premium discounts for healthy lifestyles, loyalty rewards, or access to financial planning services. These added benefits can influence the overall value of the policy.

Customization Options

When it comes to term life insurance policies for high-income earners, customization options play a crucial role in tailoring coverage to meet specific needs and circumstances. By adding riders and other add-ons, individuals can enhance their policy to provide comprehensive protection for themselves and their loved ones.

Riders and Add-Ons

- Riders for Critical Illness Coverage: High-income earners can opt for riders that provide coverage in case of critical illnesses such as cancer, heart attack, or stroke. This ensures financial protection in the event of a serious health issue.

- Accidental Death Benefit Rider: This rider offers an additional sum assured in case of death due to an accident, providing extra financial support for the family.

- Waiver of Premium Rider: In case of a disability that prevents the policyholder from working, this rider waives off future premium payments while keeping the policy active.

- Child Term Rider: This rider provides coverage for the policyholder's children, ensuring their financial security in case of any unfortunate event.

Tailored Policy Examples

- Example 1:A high-income earner with a family history of critical illnesses can customize their policy by adding a critical illness rider to ensure adequate coverage for potential health risks.

- Example 2:For individuals with a high-risk profession or lifestyle, adding an accidental death benefit rider can provide additional financial support to their loved ones in case of unforeseen accidents.

- Example 3:Those with young children can opt for a child term rider to secure their children's future financially, ensuring they are protected in any eventuality.

Epilogue

In conclusion, Term Life Insurance Quotes for High Income Earners offer a crucial financial safeguard. This discussion highlights the significance of customizing policies to meet the unique needs of high-income individuals, ensuring comprehensive coverage and peace of mind.

FAQ Overview

What factors should high-income earners consider when choosing term life insurance?

High-income earners should consider their income level, coverage amount, and policy duration to ensure adequate protection.

How can customization options enhance a term life insurance policy for high-income individuals?

Customization options such as riders and add-ons can provide tailored coverage for specific needs, making the policy more comprehensive.

What influences the cost of term life insurance premiums for high-income earners?

Factors like age, health condition, and coverage amount can impact the cost of premiums for high-income individuals.