Embarking on the journey of retirement planning can be both exciting and daunting. One crucial aspect to consider is how life insurance quotes fit into this equation. In this guide, we will delve into the intricate relationship between life insurance and retirement planning, exploring key factors, strategies, and considerations along the way.

Get ready to discover how to secure your future with the right life insurance choices.

Understanding Life Insurance Quotes

When looking at life insurance quotes, it's important to understand the various components that are typically included, as well as the factors that can influence the premiums you may have to pay. Additionally, knowing the different types of life insurance policies offered in the market can help you make an informed decision based on your needs and financial goals.

Components of Life Insurance Quotes

Life insurance quotes usually include the following components:

- The amount of coverage (death benefit) you are applying for.

- The length of the policy term (e.g., 10, 20, or 30 years).

- Your age and overall health, which can impact the cost of the policy.

- Whether you choose a term life insurance policy or a permanent life insurance policy.

- Any additional riders or optional features you may want to add to the policy.

Factors Influencing Life Insurance Premiums

There are several factors that can influence the premiums you pay for a life insurance policy:

- Your age and health status: Younger and healthier individuals typically pay lower premiums.

- The amount of coverage: Higher coverage amounts usually result in higher premiums.

- The type of policy: Permanent life insurance policies tend to have higher premiums than term life insurance policies.

- Lifestyle factors: Factors such as smoking, occupation, and hobbies can impact your premiums.

- Insurance company: Different insurers may offer different rates for the same coverage.

Types of Life Insurance Policies

There are two main types of life insurance policies commonly offered in the market:

- Term life insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years) and typically offers lower premiums.

- Permanent life insurance: Offers coverage for your entire life and includes a cash value component that can grow over time.

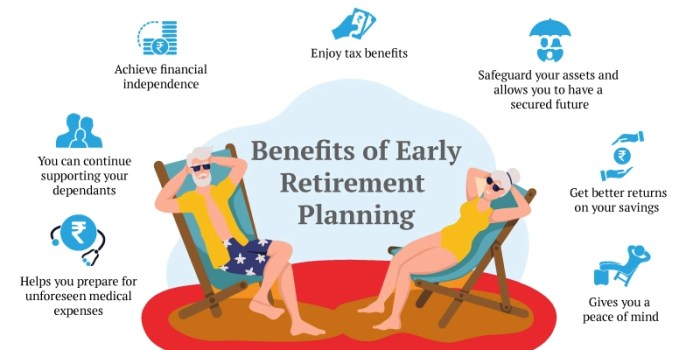

Importance of Aligning Life Insurance with Retirement Planning

When it comes to retirement planning, integrating life insurance into the strategy is essential for various reasons. Let's explore why aligning life insurance with retirement planning is crucial and how it can complement your overall financial goals.

Enhancing Financial Security

Life insurance provides a safety net for your loved ones in the event of your passing, ensuring they are financially protected. By aligning life insurance with retirement planning, you can secure their future and alleviate any potential financial burdens they may face.

Income Replacement

Life insurance can serve as a source of income replacement during retirement. In the unfortunate event of your death, life insurance proceeds can help replace lost income, allowing your spouse or dependents to maintain their standard of living without depleting retirement savings.

Debt Repayment and Estate Planning

Integrating life insurance into your retirement plan can also help with debt repayment and estate planning. Life insurance proceeds can be used to settle any outstanding debts or cover estate taxes, ensuring a smooth transfer of assets to your beneficiaries.

Long-Term Care and Legacy Planning

Some life insurance policies offer benefits for long-term care or can be used to leave a legacy for future generations. By aligning life insurance with retirement planning, you can secure additional protection and create a lasting impact beyond your lifetime.

Factors to Consider When Choosing Life Insurance for Retirement

When selecting life insurance for retirement planning, individuals need to carefully consider several key factors to ensure they have adequate coverage and financial security in their later years.

Role of Term Life Insurance vs. Permanent Life Insurance in Retirement Planning

- Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is generally more affordable than permanent life insurance.

- Permanent life insurance, such as whole life or universal life, offers coverage for the entire lifetime of the insured and includes a cash value component that can grow over time.

- When planning for retirement, individuals may opt for term life insurance to cover specific financial obligations, while permanent life insurance can provide lifelong protection and potential cash value accumulation.

How Health and Age Affect Life Insurance Choices for Retirement

- Health plays a crucial role in determining life insurance premiums, with individuals in good health typically qualifying for lower rates.

- Younger individuals generally pay lower premiums for life insurance compared to older individuals, as age is a significant factor in assessing life expectancy.

- For retirement planning, individuals should consider obtaining life insurance coverage at a younger age and in good health to secure more affordable premiums and ensure long-term financial protection.

Strategies for Maximizing Life Insurance Benefits in Retirement

Life insurance can be a valuable asset in retirement planning, providing financial security for your loved ones and helping to cover expenses in case of unexpected events. Here are some strategies to help you maximize the benefits of your life insurance policy as you plan for retirement.

Regularly Review and Adjust Coverage

It's essential to review your life insurance coverage regularly to ensure it aligns with your changing financial needs in retirement. As your financial situation evolves, you may need to adjust your coverage amount or type of policy to better suit your goals.

Consider factors such as changes in income, family dynamics, and overall financial health when reviewing your life insurance policy.

Consider a Combination of Policies

One strategy for maximizing life insurance benefits in retirement is to consider a combination of policies. For example, you might have a term life insurance policy to cover specific financial obligations during your working years and a permanent life insurance policy to provide lifelong coverage and potential cash value accumulation.

By diversifying your life insurance portfolio, you can tailor your coverage to different needs and stages of life.

Explore Living Benefits and Riders

Living benefits and riders can enhance the value of your life insurance policy by providing additional benefits beyond the death benefit. Consider adding riders such as accelerated death benefit riders, long-term care riders, or critical illness riders to your policy.

These features can provide financial support in case of a qualifying event, allowing you to access a portion of the death benefit while you're still alive.

Work with a Financial Advisor

To ensure that your life insurance coverage aligns with your retirement goals, consider working with a financial advisor who specializes in retirement planning. A professional advisor can help you assess your financial needs, analyze your current life insurance coverage, and recommend adjustments or additional strategies to optimize your benefits in retirement.

Last Recap

As we wrap up our discussion on life insurance quotes aligned with retirement planning, it's clear that strategic decision-making in this area can significantly impact your financial security during your golden years. By understanding the nuances of life insurance and its role in retirement, you can pave the way for a more stable and worry-free future.

Here's to making informed choices that lead to a fulfilling retirement ahead.

Clarifying Questions

What factors influence life insurance premiums?

Life insurance premiums are influenced by various factors such as age, health status, coverage amount, type of policy, and lifestyle habits.

How can life insurance complement retirement savings?

Life insurance can provide a financial cushion for your loved ones and help cover any outstanding debts or expenses, reducing the financial burden on your retirement savings.

What role does health play in life insurance choices for retirement?

Health plays a crucial role as it can impact the cost of premiums and the type of coverage available. Maintaining good health can lead to more favorable life insurance options.