Exploring the realm of auto insurance quotes in 2025, we delve into the common pitfalls that can impact your premiums. From inaccurate information to coverage options, this guide will navigate you through the complexities of securing the best quote for your vehicle.

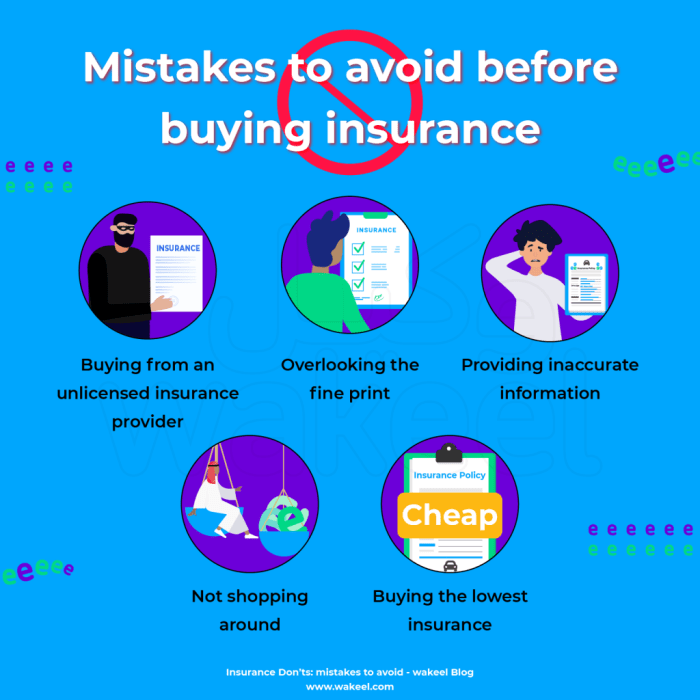

Common Mistakes When Getting an Auto Insurance Quote

When obtaining an auto insurance quote, it is crucial to provide accurate information to ensure you receive the most appropriate coverage at the best possible rate. Failing to provide precise details can lead to various complications and potential financial repercussions down the line.

Importance of Providing Accurate Information

When filling out your auto insurance application, it is essential to be truthful and precise with the details you provide. Inaccurate information can result in your policy being voided or claims being denied in the future. For example, providing incorrect information about your driving record or vehicle specifications could lead to serious consequences if discovered later on.

Impact of Underestimating Mileage or Vehicle Usage

Underestimating the mileage you drive or the intended use of your vehicle can have a significant impact on your insurance premiums. Insurance companies use this information to assess risk and determine your rates. If you underestimate your mileage or fail to disclose that you use your vehicle for business purposes, you may end up paying higher premiums than necessary.

Risks of Omitting Previous Claims or Accidents

Failing to disclose previous claims or accidents when obtaining an auto insurance quote can also have serious consequences. Insurance companies rely on this information to assess your risk as a driver and determine the cost of your policy. By omitting this information, you may face higher premiums or even have your coverage denied in the event of a claim.

Examples of How Inaccurate Information Can Lead to Higher Premiums

For instance, if you provide incorrect information about your annual mileage and underestimate the number of miles you drive, your insurance company may assume you are at a lower risk of being involved in an accident. As a result, they may offer you a lower premium.

However, if you end up driving more miles than stated, you could be at a higher risk, leading to potential rate increases or coverage issues.

Understanding Coverage Options

When getting an auto insurance quote, it's crucial to understand the different coverage options available to ensure you have the right protection in place. Let's delve into the types of coverage typically included in auto insurance quotes and compare the benefits of comprehensive coverage versus liability-only coverage.

Types of Coverage

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Comprehensive Coverage: This covers damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Collision Coverage: This covers damages to your vehicle in the event of a collision with another vehicle or object.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers regardless of fault.

Comprehensive vs. Liability-only Coverage

- Comprehensive Coverage: Provides broader protection by covering a wider range of incidents, offering peace of mind for unexpected events.

- Liability-only Coverage: Offers the minimum required coverage by law, which may be more cost-effective but leaves you vulnerable to certain risks.

Adding Extras like Roadside Assistance

- Adding extras like roadside assistance can increase the overall cost of your insurance quote, but it provides valuable support in case of emergencies like breakdowns or flat tires.

- Consider whether the added cost is worth the convenience and peace of mind that roadside assistance can offer.

Importance of Understanding Deductible Options

- Your deductible is the amount you pay out of pocket before your insurance kicks in to cover the rest of the claim.

- Choosing a higher deductible can lower your premium but means you'll pay more in the event of a claim.

- Understanding your deductible options helps you find the right balance between upfront costs and potential savings in the long run.

Utilizing Online Quote Tools Effectively

When it comes to getting auto insurance quotes, utilizing online tools can streamline the process and help you find the best coverage for your needs. Here are some tips on how to make the most out of online tools:

Benefits of Using Online Tools

- Convenience: Online tools allow you to get multiple quotes from different providers without having to visit various offices.

- Time-saving: You can quickly compare prices and coverage options in one place, saving you time and effort.

- Accessibility: These tools are available 24/7, allowing you to get quotes at your convenience.

Tips for Accurate Input

- Provide accurate information: Make sure to enter correct details about your vehicle, driving history, and coverage needs to get an accurate quote.

- Double-check your inputs: Review the information you've entered before submitting to avoid any errors that could affect the quote.

- Be consistent: Use the same information across all forms to ensure accurate comparisons between quotes.

Comparing Quotes from Different Providers

- Look beyond the price: Consider coverage limits, deductibles, and additional benefits offered by each provider when comparing quotes.

- Read reviews: Check customer reviews and ratings to get an idea of the customer service experience with each provider.

- Ask questions: If you're unsure about any aspect of the coverage, don't hesitate to reach out to the insurance company for clarification.

Importance of Reviewing Details

- Check coverage limits: Make sure the coverage options and limits meet your needs and comply with state requirements.

- Verify discounts: Ensure that all eligible discounts have been applied to the quote to get the best price possible.

- Review policy details: Take the time to go through the policy documents to understand what is covered and any exclusions that may apply.

Factors That Influence Auto Insurance Quotes

When it comes to determining auto insurance quotes, various factors come into play that can significantly impact the final cost. Understanding these factors can help individuals make informed decisions when shopping for auto insurance coverage.

Personal Information Impact

- Age: Younger drivers are often considered high-risk and may face higher insurance premiums compared to older, more experienced drivers.

- Driving History: A clean driving record with no accidents or traffic violations typically results in lower insurance rates, while a history of accidents or tickets can lead to increased premiums.

Role of Vehicle Type

- The type of vehicle being insured can also impact insurance costs. Factors such as the make and model of the car, its age, safety features, and likelihood of theft all play a role in determining premiums.

Location and Local Regulations

- Where you live can affect your insurance premiums due to factors like crime rates, traffic congestion, and weather conditions. Additionally, local regulations and requirements may vary, influencing the cost of coverage.

Additional Influencing Factors

- Credit Score: In some cases, insurance companies may consider an individual's credit score when calculating premiums. A higher credit score can potentially lead to lower insurance rates.

Closing Notes

Wrapping up our discussion on auto insurance quote mistakes to avoid in 2025, it's crucial to stay informed and vigilant when seeking quotes. Remember, a little attention to detail now can save you from potential headaches in the future.

Query Resolution

Why is providing accurate information important when getting an auto insurance quote?

Accurate information ensures that the quote you receive is based on your true circumstances, reducing the risk of surprises or disputes in the future.

How does adding extras like roadside assistance affect an auto insurance quote?

Adding extras like roadside assistance can increase your premium, as it adds to the overall coverage provided by the policy. Make sure to weigh the benefits against the cost.

What role does the type of vehicle play in determining insurance costs?

The type of vehicle can impact insurance costs due to factors like repair costs, safety ratings, and likelihood of theft. More expensive or high-performance vehicles typically come with higher premiums.

How can location and local regulations affect insurance premiums?

Location can impact insurance premiums due to varying levels of risk associated with different areas. Local regulations may also mandate certain coverage types or minimum coverage limits.

What additional factors besides personal information can influence an auto insurance quote?

Factors like credit score, occupation, and marital status can also influence auto insurance quotes. Insurers use these details to assess your risk profile and determine the premium accordingly.