Delving into the realm of Home and Auto Insurance: One Policy or Separate Coverage opens up a world of possibilities. From weighing the advantages of bundling to exploring customization options, this topic is ripe with insights that can help you make informed decisions.

As we navigate through the various factors and coverage options, you'll find yourself equipped with the knowledge needed to choose the best insurance approach for your specific needs.

Pros and Cons of Bundling Home and Auto Insurance

When it comes to insurance, bundling your home and auto policies can have both advantages and disadvantages. Here's a breakdown of the pros and cons to consider before making a decision.

Advantages of Bundling

- Bundling home and auto insurance can lead to significant cost savings. Insurance companies often offer discounts for combining policies, resulting in lower overall premiums.

- Managing one policy for both home and auto insurance is more convenient and efficient. You'll have a single point of contact for any inquiries or claims, simplifying the process.

- Some insurance companies may offer additional benefits or perks for bundling policies, such as enhanced coverage options or priority customer service.

Drawbacks of Bundling

- While bundling can save you money, it's essential to compare the total cost of bundled coverage with separate policies. In some cases, individual policies may be cheaper, especially if you have unique insurance needs.

- If you need to make a claim on one policy, it could potentially affect the other. For example, a claim on your auto insurance could impact your home insurance rates when bundled together.

- Switching insurance providers or canceling one policy within a bundle may result in losing the bundled discount, leading to higher premiums in the future.

Examples of Bundling

John saved 20% on his insurance premiums by bundling his home and auto policies with the same provider. This resulted in annual savings of $500.

On the other hand, Sarah experienced an issue when her home insurance rates increased due to a claim on her auto policy, both of which were bundled together.

Factors to Consider when Choosing Between One Policy or Separate Coverage

When deciding between bundling home and auto insurance or purchasing separate policies, there are several key factors to consider to make an informed choice.

Cost Savings

- One of the primary factors to consider is the potential cost savings associated with bundling home and auto insurance. Insurance companies often offer discounts for customers who choose to bundle their policies together.

- Compare the total cost of bundling versus purchasing separate policies to determine which option provides the most cost-effective solution for your specific insurance needs.

Convenience and Simplification

- Bundling home and auto insurance can simplify the insurance process by consolidating your policies with one provider. This can make it easier to manage payments, claims, and policy renewals.

- Consider your preference for dealing with a single insurance company for all your coverage needs versus managing separate policies with different providers.

Coverage and Customization

- Review the coverage options and customization opportunities available through bundling versus separate policies. Consider whether bundling limits your ability to tailor coverage to your specific needs.

- Assess whether bundling home and auto insurance allows you to take advantage of combined coverage options or if separate policies offer more flexibility in choosing coverage levels.

Coverage Options in Home and Auto Insurance

When it comes to home and auto insurance, there are various coverage options available to protect your assets and finances. Understanding the types of coverage for both home and auto insurance is essential in making informed decisions about your insurance needs.

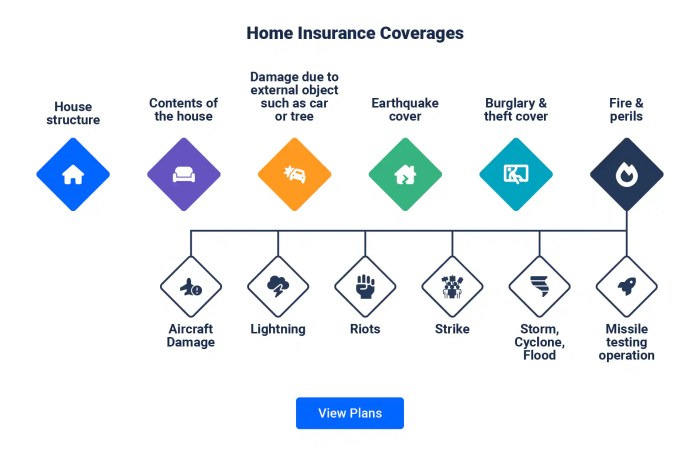

Types of Coverage for Home Insurance

Home insurance typically includes several types of coverage to protect your home and belongings. Some common types of coverage in home insurance policies include:

- Dwelling coverage: This type of coverage protects the physical structure of your home in case of damage from covered perils such as fire, wind, or vandalism.

- Personal property coverage: This coverage helps replace or repair personal belongings inside your home, like furniture, electronics, and clothing, if they are damaged or stolen.

- Liability coverage: Liability coverage protects you if someone is injured on your property and you are found legally responsible. It can help cover medical expenses and legal fees.

- Additional living expenses: If your home becomes uninhabitable due to a covered event, this coverage can help pay for temporary living arrangements like hotel expenses.

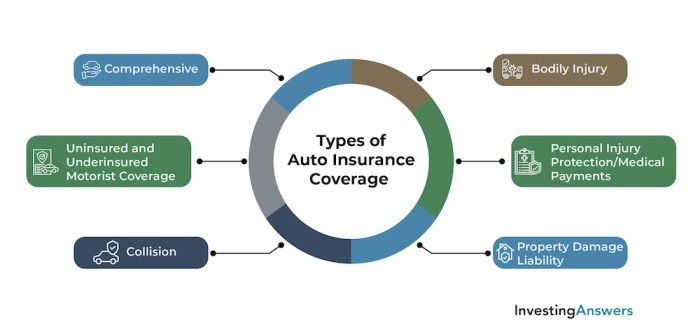

Different Coverage Options for Auto Insurance

Auto insurance offers various types of coverage to protect you and your vehicle in different situations. Some common coverage options in auto insurance policies include:

- Liability coverage: This coverage helps pay for injuries and property damage you cause to others in an accident.

- Collision coverage: Collision coverage helps pay for repairs to your vehicle after a collision with another vehicle or object.

- Comprehensive coverage: Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters.

- Personal injury protection (PIP): PIP coverage helps cover medical expenses for you and your passengers after an accident, regardless of who is at fault.

Coverage Differences in Bundled vs. Separate Policies

When you bundle your home and auto insurance policies, you may be eligible for discounts and other benefits that you wouldn't get with separate policies. For example, some insurance companies offer a discount on your premiums when you bundle both policies with them.

Additionally, bundling can make it easier to manage your policies and claims with a single insurance provider. On the other hand, separate policies may offer more flexibility in choosing coverage limits and options tailored to each specific need. It's essential to compare the cost and coverage options of bundled versus separate policies to determine which option is best for you.

Customization and Flexibility in Policies

When it comes to home and auto insurance, customization and flexibility in policies are crucial factors to consider. Whether you opt for a bundled policy or separate coverage, the ability to tailor your insurance to fit your specific needs can make a significant difference in the level of protection you receive.

Let's explore how customization and flexibility play out in both scenarios.

Level of Customization with Bundled Policies

With bundled policies, you have the convenience of managing your home and auto insurance under one umbrella. While this may offer certain discounts and simplified paperwork, the level of customization may be limited. Bundled policies typically come with pre-packaged coverage options, which may not fully address your unique requirements.

For example, if you have specific high-value items in your home that require additional coverage, a bundled policy might not allow you to adjust the coverage limits for those items individually.

Flexibility with Separate Coverage

On the other hand, opting for separate home and auto insurance policies provides you with more flexibility to customize your coverage. You can choose different coverage limits, deductibles, and add-on options for each policy based on your needs and budget.

For instance, if you own multiple vehicles with varying usage patterns, having separate auto insurance policies allows you to tailor the coverage for each vehicle accordingly.

Scenarios Where Customization is Crucial

Customization becomes crucial in scenarios where your insurance needs are unique or unconventional. For example, if you run a home-based business, you may need additional liability coverage that is not typically included in standard policies. With separate coverage, you can easily add a business endorsement to your home insurance policy to protect your business assets.

Similarly, if you have a vintage car that requires specialized coverage, having the flexibility to customize your auto insurance policy becomes essential to ensure adequate protection for your prized possession.

Outcome Summary

In conclusion, the decision between opting for one policy or separate coverage hinges on a multitude of factors. By understanding the nuances of bundling, customization, and coverage options, you're empowered to make a choice that aligns perfectly with your unique requirements and preferences.

Key Questions Answered

What are the advantages of bundling Home and Auto Insurance?

By bundling both policies, you can often enjoy discounted rates and the convenience of managing your insurance needs under one provider.

How do individual circumstances impact the choice between one policy or separate coverage?

Factors like the number of vehicles, the value of your home, and your driving history can all play a significant role in determining the most cost-effective insurance approach.

Can customization options differ between bundled policies and separate coverage?

Yes, while bundled policies offer some level of customization, separate coverage typically allows for more tailored options to suit your specific needs.