Exploring the latest trends in auto insurance quotes in the US and Europe unveils a fascinating landscape of differences and similarities. From market dynamics to technological innovations, this topic delves into the intricate world of auto insurance pricing.

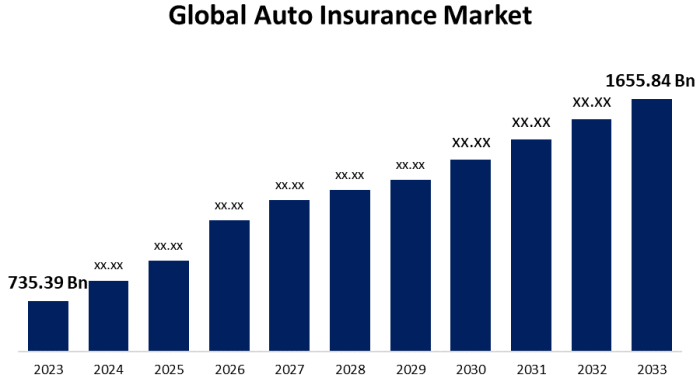

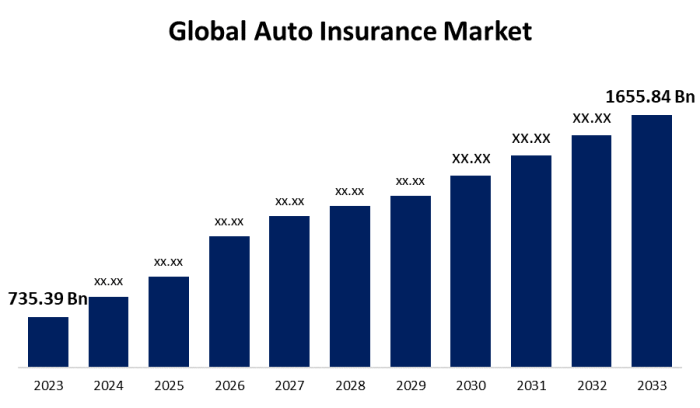

Auto Insurance Market Overview

The auto insurance industry in both the US and Europe plays a crucial role in providing financial protection to vehicle owners in case of accidents, theft, or other damages. However, there are significant differences between the two markets in terms of regulations, coverage options, and major players.

Key Differences Between US and European Auto Insurance Markets

- In the US, auto insurance is largely regulated at the state level, leading to variations in coverage requirements and pricing across different states. In contrast, European countries often have standardized regulations set at the national level.

- European auto insurance markets typically offer more comprehensive coverage options, including protection against uninsured motorists and legal expenses, whereas US policies tend to focus more on liability and collision coverage.

- The major players in the US auto insurance market include companies like State Farm, GEICO, and Progressive, while European markets are dominated by insurers such as Allianz, AXA, and Zurich.

Regulations Governing Auto Insurance in the US and Europe

- In the US, auto insurance regulations vary by state but generally require drivers to carry a minimum amount of liability coverage. Failure to comply with these requirements can result in fines or license suspension.

- European countries have mandatory auto insurance laws that ensure all drivers are financially responsible for damages they may cause in an accident. Penalties for driving without insurance can be severe, including fines and vehicle impoundment.

- Both regions have regulatory bodies that oversee the insurance industry and ensure compliance with laws and regulations to protect consumers and maintain market stability.

Factors Influencing Auto Insurance Quotes

The cost of auto insurance quotes is influenced by various factors in both the US and Europe. These factors can impact the pricing of auto insurance policies significantly.

Demographic Factors

Demographic factors play a crucial role in determining auto insurance premiums. Age, gender, marital status, and location are some of the key demographic variables that insurers consider. For example, young male drivers under 25 are often charged higher premiums due to their higher risk of accidents.

Additionally, married individuals are perceived as more responsible drivers, leading to lower insurance rates.

Vehicle Types and Usage

The type of vehicle and its intended usage also affect auto insurance premiums. Sports cars and luxury vehicles typically have higher insurance costs due to their higher repair and replacement costs. Moreover, vehicles used for commercial purposes or long commutes may be charged higher premiums as they are on the road more frequently, increasing the likelihood of accidents.

Technology and Innovation Trends

Technology plays a crucial role in shaping auto insurance trends in both the US and Europe. From telematics to data analytics, advancements in technology are revolutionizing the auto insurance landscape. Let's delve into how these innovations are impacting the industry.

Telematics and Data Analytics

Telematics, which involves using devices to monitor driving behavior, has become increasingly popular among auto insurance companies. By collecting data on factors like speed, mileage, and braking patterns, insurers can more accurately assess risk and tailor premiums to individual drivers.

Data analytics further enhances this process by analyzing vast amounts of data to identify trends and make informed decisions.

- Telematics devices provide real-time feedback to drivers, encouraging safer habits and potentially lowering insurance costs for those who demonstrate responsible driving behavior.

- Data analytics allows insurers to better predict risk, prevent fraud, and personalize insurance offerings based on a driver's specific needs and driving habits.

- By leveraging telematics and data analytics, auto insurance companies can improve customer satisfaction and loyalty by offering more competitive rates and tailored coverage options.

AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning algorithms has also had a significant impact on auto insurance pricing and customer experience. These technologies enable insurers to automate processes, enhance risk assessment, and streamline claims management.

- AI-powered chatbots are being used to provide instant customer support, answer queries, and guide policyholders through the claims process efficiently.

- Machine learning algorithms analyze historical data to predict future claims and pricing trends, helping insurers adjust premiums and coverage options accordingly.

- AI-driven fraud detection systems flag suspicious activities, reducing fraudulent claims and ultimately lowering costs for both insurers and policyholders.

COVID-19 Impact on Auto Insurance

The COVID-19 pandemic has had a significant impact on auto insurance trends in both the US and Europe. As lockdowns were enforced, many people started working from home, leading to a decrease in daily commuting and overall driving activity. This shift in behavior has resulted in various changes within the auto insurance industry.

Changes in Driving Behavior and Insurance Pricing

During the pandemic, with fewer vehicles on the road, there was a noticeable decrease in the number of accidents and claims. As a result, many insurance companies adjusted their pricing models to reflect the reduced risk. Some insurers even offered discounts or rebates to policyholders due to the lower likelihood of accidents during this time.

- Insurance premiums were adjusted to account for reduced driving activity.

- Some insurers introduced pay-as-you-drive or usage-based insurance policies to better align premiums with actual driving habits.

- Changes in driving behavior during the pandemic led to a reevaluation of risk factors by insurance providers.

Long-Term Shifts in the Auto Insurance Industry

The pandemic has brought about long-term changes in the auto insurance industry that are likely to persist even after the crisis has subsided. Insurance companies have recognized the importance of adapting to new trends and technologies to meet the evolving needs of customers.

As digitalization and remote work become more prevalent, insurers are exploring innovative ways to engage with policyholders and offer more personalized services.

- Increased focus on digitalization and online services for policy management and claims processing.

- Greater emphasis on flexible insurance products that cater to changing driving patterns and behaviors.

- Shift towards more data-driven approaches in underwriting and pricing to accurately assess risk factors.

Final Wrap-Up

In conclusion, the discussion on Auto Insurance Quote Trends in the US and Europe sheds light on the evolving nature of this industry. By understanding the various factors at play, individuals and businesses can make informed decisions when it comes to auto insurance.

FAQ Insights

What are some key differences between auto insurance markets in the US and Europe?

In the US, auto insurance is largely privatized, while in Europe, there is a mix of private and public insurance systems.

How do demographic factors impact auto insurance pricing in the US and Europe?

Different age groups, driving histories, and even credit scores can influence the cost of auto insurance premiums in both regions.

What role does technology play in shaping auto insurance trends in the US and Europe?

Technology like telematics and data analytics is revolutionizing how auto insurance is priced and personalized for customers in both regions.