Delving into the realm of Cheap Full Coverage Insurance vs Minimum Coverage Explained, this introductory passage aims to intrigue and inform readers with a blend of casual formality.

The following section will provide detailed insights and comparisons between these two types of insurance coverage.

Understanding Cheap Full Coverage Insurance

When it comes to insurance, opting for cheap full coverage can be a tempting choice for many individuals. This type of insurance typically includes coverage for a wide range of situations, providing more comprehensive protection compared to minimum coverage policies.

What Cheap Full Coverage Insurance Typically Includes

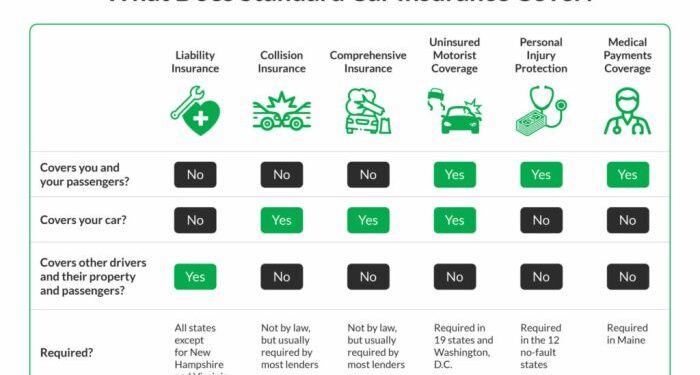

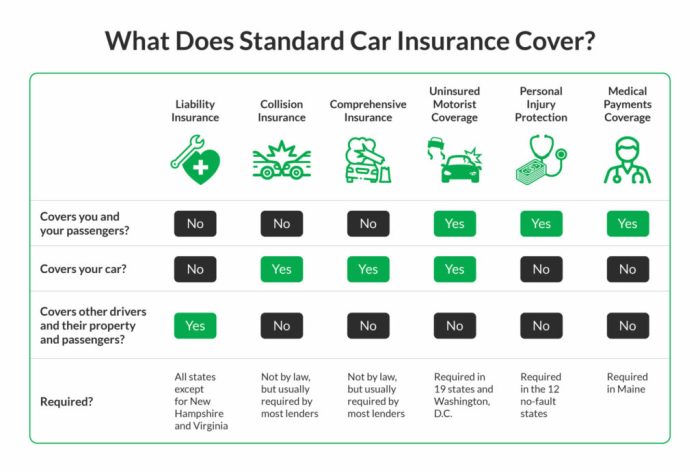

- Liability coverage for bodily injury and property damage

- Collision coverage for damage to your vehicle in an accident

- Comprehensive coverage for non-collision incidents like theft, vandalism, or natural disasters

- Uninsured/underinsured motorist coverage

Examples of Situations Where Opting for Cheap Full Coverage Insurance is Beneficial

- If you have a newer or more expensive vehicle that you want to protect in case of an accident

- If you live in an area prone to natural disasters or high crime rates

- If you have a history of accidents or traffic violations and want extra protection

Potential Drawbacks of Choosing Cheap Full Coverage Insurance

- Higher premiums compared to minimum coverage policies

- Deductibles may be higher, leading to out-of-pocket expenses in case of a claim

- Not all situations may be covered, leading to potential gaps in protection

Explaining Minimum Coverage Insurance

Minimum coverage insurance is a type of auto insurance policy that provides the basic legal requirements mandated by the state. It typically includes coverage for bodily injury and property damage liability, but does not offer comprehensive or collision coverage.

Scenarios Suitable for Minimum Coverage Insurance

- For drivers on a tight budget who need to meet minimum legal requirements

- For older vehicles with lower value that may not require full coverage

- For individuals who have minimal assets to protect

Advantages and Disadvantages of Minimum Coverage Insurance

Minimum coverage insurance has its own set of pros and cons compared to full coverage policies.

- Advantages:

- Lower premiums, making it more affordable for budget-conscious individuals

- Meets the legal requirements for driving in most states

- Disadvantages:

- Limited coverage may not be enough to cover all damages in an accident

- No protection for your own vehicle in case of an at-fault accident

- May leave you vulnerable to out-of-pocket expenses in certain situations

Cost Differences Between Full Coverage and Minimum Coverage

When it comes to insurance, one of the key factors that individuals consider is the cost difference between full coverage and minimum coverage. Understanding how these costs differ can help drivers make informed decisions about their coverage options.Full coverage insurance typically costs more than minimum coverage due to the broader protection it offers.

Full coverage includes not only liability coverage but also comprehensive and collision coverage, which can protect your vehicle in various situations such as accidents, theft, or natural disasters. On the other hand, minimum coverage only meets the state's minimum requirements for liability insurance.

Factors Influencing Cost Gap

- Level of Coverage: The extent of coverage provided by full coverage insurance compared to minimum coverage directly impacts the cost difference between the two. The more comprehensive the coverage, the higher the premium.

- Vehicle Type: The type of vehicle you drive can also influence the cost gap. Expensive or high-performance vehicles may require higher coverage limits, leading to increased premiums for full coverage.

- Driving Record: Your driving history plays a significant role in determining insurance premiums. A clean driving record can result in lower rates for both full coverage and minimum coverage, but the impact may be more pronounced for full coverage.

- Location: Where you live can affect insurance costs as well. Urban areas or regions with higher rates of accidents or theft may result in higher premiums for both types of coverage.

Legal Requirements and Considerations

In the United States, each state has its own set of legal requirements for auto insurance coverage. It is important to understand the differences between meeting minimum coverage requirements and having full coverage to ensure compliance with the law and adequate protection.

State-specific Insurance Requirements

Different states have varying minimum auto insurance coverage requirements. For example, some states may require liability insurance to cover bodily injury and property damage, while others may also mandate uninsured/underinsured motorist coverage. It is crucial for drivers to be aware of the specific insurance requirements in their state of residence to avoid penalties or legal issues.

Differences Between Minimum and Full Coverage

Meeting minimum coverage requirements typically only provides basic protection for others in the event of an accident that is deemed your fault. On the other hand, having full coverage insurance goes beyond the minimum requirements and offers additional protection for your own vehicle, such as comprehensive and collision coverage.

While full coverage may offer more comprehensive protection, it also tends to come with higher premiums.

Variability Based on State of Residence

Insurance requirements can vary significantly based on the state of residence. Some states may have higher minimum coverage limits or additional requirements, such as personal injury protection (PIP) or medical payments coverage. Understanding the specific insurance regulations in your state can help you make informed decisions when selecting the right coverage for your needs.

Ending Remarks

Wrapping up our discussion on Cheap Full Coverage Insurance vs Minimum Coverage Explained, this concluding paragraph offers a concise summary of the key points discussed, leaving readers with a clear understanding of the topic.

Question & Answer Hub

What does cheap full coverage insurance typically include?

Cheap full coverage insurance usually encompasses comprehensive and collision coverage, providing extensive protection for your vehicle.

When is opting for cheap full coverage insurance beneficial?

Opting for cheap full coverage insurance is beneficial when you have a new or expensive vehicle that you want to protect against potential damages.

What are the potential drawbacks of choosing cheap full coverage insurance?

Drawbacks of cheap full coverage insurance may include higher premiums and potential limitations on coverage options.

What scenarios are suitable for minimum coverage insurance?

Minimum coverage insurance is suitable for older vehicles with lower value or for individuals on a tight budget who need to meet legal requirements.

How does the cost of cheap full coverage insurance differ from minimum coverage?

Cheap full coverage insurance typically costs more than minimum coverage due to the extensive protection it offers.